China's pulp and paper sector is witnessing transformative growth with Huatai Group's announcement of its monumental 16-billion-yuan investment in a fully integrated forest-pulp-paper project located in Yulin, Guangxi.

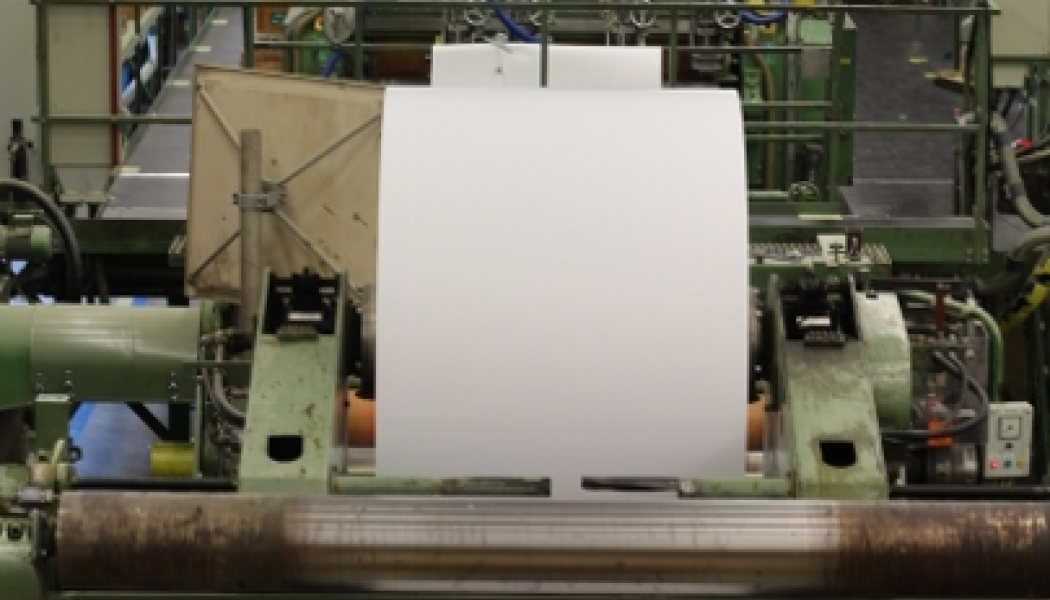

This state-of-the-art facility is designed to produce 400,000 tons of dissolving pulp, 600,000 tons of chemical wood pulp, and 900,000 tons of eco-friendly industrial paper each year. Supported by a vast 1.5-million-mu raw material forest base—equivalent to approximately 100,000 hectares—the project exemplifies the industry's shift toward vertical integration, securing supply chains against volatile raw material prices and enhancing operational resilience.

The initiative aligns with broader trends in China's paper industry, where capacity expansions in coastal provinces like Shandong and Guangxi are reshaping global pulp dynamics. According to industry reports, new large-scale projects from leaders such as Sun Paper and Huatai are set to commence operations from the fourth quarter of 2025 through 2026, amplifying China's dominance in paper production. Between January and August 2025, China's machine-made paper and paperboard output reached 106.659 million tons, up 2.7% year-on-year, though operating rates hovered around 60%, underscoring structural overcapacity challenges.

This project falls under the **Papermaking** and **Chemical Pulping** categories, incorporating advanced chemical recovery processes and sustainable forestry practices. By controlling the entire value chain from forest cultivation to finished paper products, Huatai mitigates risks associated with pulp price fluctuations. Low-cost timber from Southeast Asia further bolsters cost competitiveness, positioning the company advantageously in international markets. The top five Chinese pulp producers now command 45% of the domestic market share, signaling rising industry concentration and a strategic pivot to integrated models.

Environmental compliance is a cornerstone of the project, adhering to the new 'Energy Consumption Limits per Unit of Output for Pulp and Paper Enterprises' effective from May 1, 2025. This regulation imposes a three-tier energy efficiency system, potentially forcing 15-20% of smaller producers out by 2027 due to heightened standards. Huatai's facility incorporates **Environment and Water Management** technologies, including advanced water treatment and waste management systems, ensuring alignment with green transformation mandates.

Globally, the project influences pulp pricing and trade flows. China's pulp imports rose 5.0% year-on-year to 24.108 million tons from January to August 2025, intensifying supply pressures. Price gaps between pulp grades, such as Russian softwood versus European varieties reaching 1,100 yuan per ton, indicate an evolving pricing structure. Meanwhile, China's paper exports surged 23% in the first half of 2025, with India emerging as a key market, prompting protective measures like India's Minimum Import Price on paperboard.